Maddy EMS Fund

History

Health and Safety Code (HSC) § 1797.98a authorizes counties to establish a Maddy Emergency Medical Services (EMS) Fund, through the adoption of a resolution by the board of supervisors, to reimburse physicians/surgeons and hospitals for the cost of uncompensated emergency care and for other discretionary EMS purposes. The Maddy EMS Fund is administered by each county, except when a county elects to have the state administer its medically indigent services program, then the county may also elect to have its Maddy EMS Fund administered by the state.

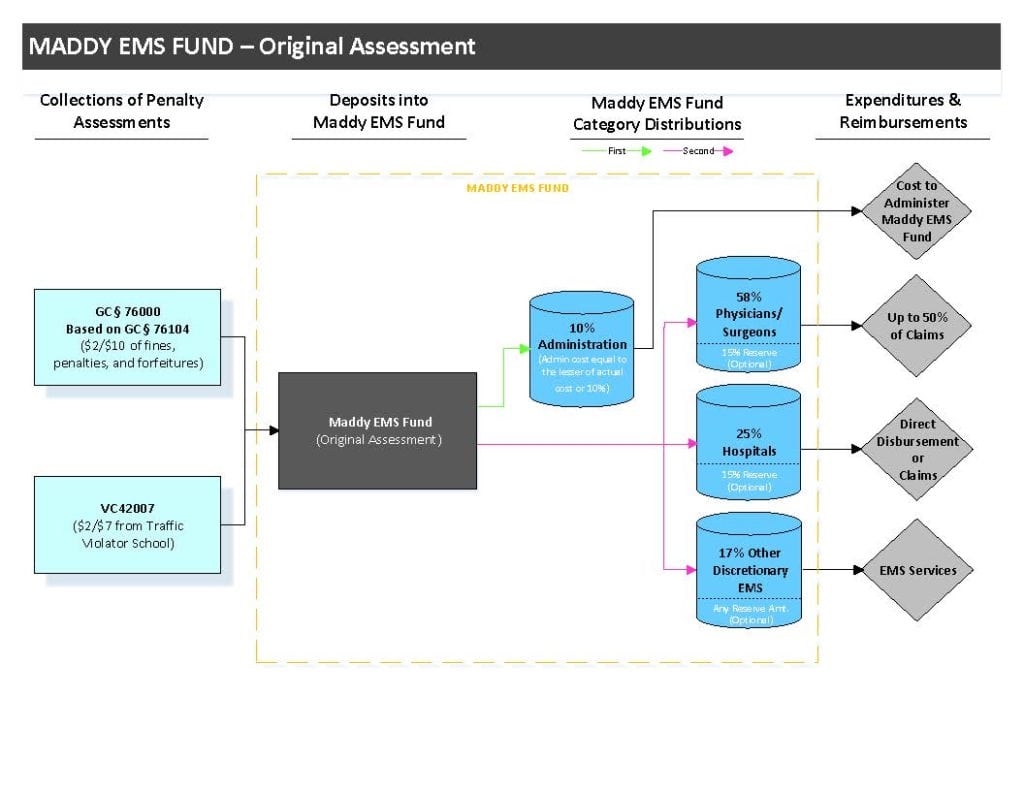

Additionally, HSC § 1797.98a(e) authorizes counties that have established the supplemental assessment, to establish a Richie’s Fund, as part of the Maddy EMS Fund. The Richie’s Fund provides funding for pediatric trauma centers throughout the county. Counties that do not maintain a pediatric trauma center shall utilize the money deposited into the fund to improve access to, and coordination of, pediatric trauma and emergency services in the county, with preference for funding given to hospitals that specialize in services to children, and physicians and surgeons who provide emergency care for children. The expenditure of the Richie’s Fund is limited to reimbursement to physicians/surgeons and hospitals for the cost of uncompensated emergency care.

Revenue

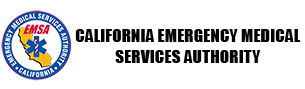

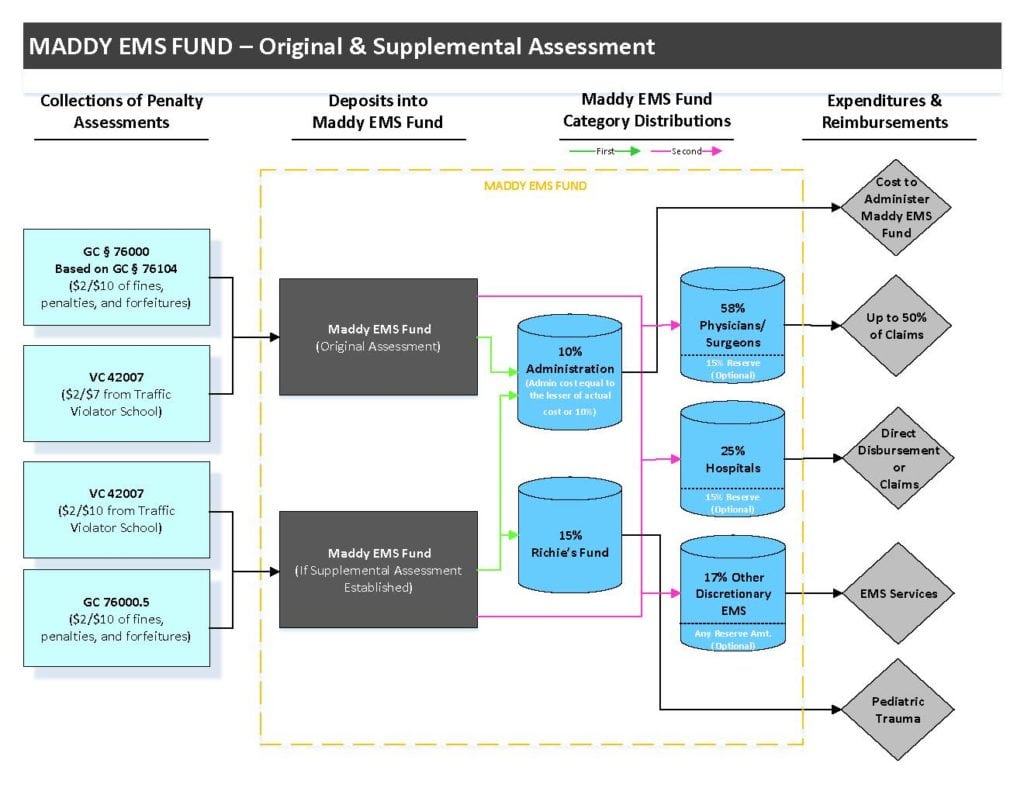

The Maddy EMS Fund (Original and Supplemental Assessment) are funded through revenues generated from local penalty assessments on fines and forfeitures for various criminal offenses and motor vehicle violations, including a portion of traffic school fees, as identified below.

Maddy EMS Fund (Original Assessment)

Government Code (GC) § 76000 based on GC § 76104

Vehicle Code (VC) § 42007

Maddy EMS Fund (Richie’s Fund Supplemental Assessment)

GC § 76000.5

VC § 42007

Penalty Assessments

Penalty assessments are collected and forwarded to the counties for deposit into the Maddy EMS Fund. The county is responsible for depositing the proper amounts into the appropriate categories within the Maddy EMS Fund. For the counties implementing the provisions of HSC § 1797.98a, utilizing penalty assessments from both GC § 76000 and GC § 76000.5, the total revenue from penalty assessments that should be deposited into the Maddy EMS Fund is as follows:

- Prior to June 1, 1991, fund growth as calculated from FY 1990/1991, or after July 1, 1991, up to 28% of the fund collected under GC § 76000, using the methodology as described in GC § 76104.

- Original penalty assessment of $2 per $10 of fines, penalties, and forfeitures collected under GC § 76000. Senate Bill (SB) 12 (Maddy, Chapter 1240, Statutes of 1987)/SB 612 (Presley, Chapter 945, Statutes of 1988).

- Supplemental penalty assessment of $2 per $10 of fines, penalties, and forfeitures collected under GC § 76000.5. SB 1773 (Alarcon, Chapter 841, Statutes of 2006).

- Penalty assessment of $2 per $7 of fees collected under GC § 76000, and $2 per $10 collected under GC § 76000.5 from Traffic Violator School under VC § 42007.

Reporting

HSC § 1797.98b mandates the California EMS Authority to annually compile and provide a summary of each county’s Maddy EMS Fund Report to the appropriate policy and fiscal committees of the Legislature. Each county establishing a Maddy EMS Fund must annually report to the California Emergency Medical Services Authority on the implementation and status of the fund by April 15 of each year for the immediately preceding FY. In order to meet the reporting requirements, the California EMS Authority has developed a Maddy EMS Fund Report template (EMSA 801) and completion instructions (EMSA 801Inst.). The completed Maddy EMS Fund Report should be submitted electronically to spencer.thompson@emsa.ca.gov, or through the mail to the following address:

California EMS Authority

Attention: Spencer Thompson

11120 International Drive, Suite 200

Rancho Cordova, CA 95670-6056

Resources

For Questions Contact

Spencer Thompson

Maddy EMS Fund Coordinator

Spencer.thompson@emsa.ca.gov

(916) 203-2548